Think of a data collection methodology as your overall game plan for gathering and analyzing information. It’s not just about the individual tools you use, but the entire strategic framework that guides your research. This framework ensures that every piece of data you collect is reliable, relevant, and directly tied to what you're trying to achieve.

The Blueprint for Actionable Insights

Imagine you're building a house. You wouldn't just show up with a pile of wood and a hammer and start building. You’d need a detailed blueprint—one that lays out the foundation, the electrical plan, the plumbing, and the purpose of every single room. Your data collection methodology is that exact blueprint for your research.

It forces you to think through every step before you even ask your first question. Without this plan, you're just collecting random facts. With it, you're building a solid case based on actionable intelligence.

Method vs. Methodology: What’s the Real Difference?

It’s incredibly common to mix up the terms "method" and "methodology," but they represent two distinct levels of thinking. Getting this right is fundamental.

- A Method is the specific tool you use to gather data. Think of it as the "how." Are you running a survey, conducting a one-on-one interview, or tracking user clicks on a website? These are all methods.

- The Methodology is the overarching strategy—the "why." It’s the logic that explains why you chose a specific method. Why is a face-to-face interview better for your sensitive topic than an anonymous survey? Why are you sampling this particular group of people? Your methodology answers these critical questions.

In short, your methodology is the sturdy bridge that connects your chosen methods directly to your research goals. It’s what ensures the data you collect will actually answer the questions you set out to explore.

Having a solid methodology is more critical now than ever. The global data collection market was valued at USD 1,869.1 million in 2023 and is expected to rocket to USD 11,767.5 million by 2030. This massive growth highlights just how essential high-quality data is for everything from business strategy to AI development. You can dive deeper into the full data collection market outlook to see how these trends are reshaping the field for 2026 and beyond.

Why a Haphazard Approach Fails

Jumping into data collection without a clear methodology is like setting sail without a map—you'll end up somewhere, but probably not where you intended. This ad-hoc approach often leads to collecting biased, inconsistent, or totally irrelevant information. The result? Wasted time, wasted money, and conclusions you can't trust.

A well-planned methodology turns a guessing game into a systematic process, giving you confidence in your findings.

The table below breaks down the key differences between a structured, methodological approach and an unplanned one.

Methodology vs Ad-Hoc Collection At a Glance

| Component | Structured Methodology | Ad-Hoc Approach |

|---|---|---|

| Planning | Proactive; designed before collection begins | Reactive; decisions made on the fly |

| Objective | Clearly defined and tied to research goals | Vague or shifts during the process |

| Consistency | Standardized process ensures reliable data | Inconsistent; data is difficult to compare |

| Bias | Actively identifies and mitigates potential bias | Prone to unintentional bias |

| Outcome | Actionable insights and defensible conclusions | Unreliable data and weak conclusions |

As you can see, a structured methodology isn't just academic—it's the practical foundation for getting results you can actually rely on.

Quantitative and Qualitative: The Numbers and The Stories

At the heart of any solid data collection plan are two core approaches: quantitative and qualitative. The best way to think about them is as two different lenses for understanding a problem. One gives you a wide, measurable view using numbers, while the other zooms in on the rich, detailed stories told with words.

Getting this distinction right isn't just a technical detail—it's the first step to making sure you're asking the right questions and getting answers that actually matter.

Quantitative Data: Answering "What" and "How Many"

Quantitative data is all about numbers. It’s objective, structured, and easy to measure. This is the kind of data you can pop into a chart, count up, and run through statistical software. It’s perfect for answering questions like "how many," "how often," or "what percentage."

Let's say you're analyzing your website's performance. Quantitative data gives you the hard facts:

- How many people visited your pricing page in the last 30 days.

- What percentage of those visitors clicked the "buy now" button.

- How often the typical customer visits your blog each month.

This kind of data is incredibly powerful for spotting large-scale trends and proving (or disproving) a hypothesis. It gives you the black-and-white numbers to measure progress and make confident, data-backed decisions.

Qualitative Data: Uncovering the "Why"

If quantitative data gives you the "what," then qualitative data uncovers the "why." This is the descriptive, unstructured stuff that’s all about context and meaning. You find it in conversations, open-ended survey responses, and direct observation.

This approach is about understanding the human element behind the numbers. Instead of just counting how many people abandoned their shopping cart, it seeks to understand why they left.

Qualitative data is like sitting down and having a real conversation with your users. It reveals their motivations, frustrations, and the subtle "aha!" moments that numbers alone will always miss.

For instance, your analytics might show a huge drop-off rate on your checkout page. That's a classic quantitative finding. To figure out the why, you'd turn to qualitative methods. Through user interviews or open-ended survey questions, you might discover that people don't trust the payment processor or find the shipping costs confusing. Exploring different survey questions examples is a great way to learn how to phrase questions that get you these kinds of actionable insights.

Combining Forces: The Mixed-Methods Approach

So, which is better? The truth is, the most insightful research doesn't pick a side—it uses both. This is called a mixed-methods approach, and it’s how you get a complete, 360-degree picture.

The two types of data can work together in a powerful feedback loop.

- Start with Quantitative: Use analytics to spot a problem area, like a landing page with a low conversion rate.

- Follow up with Qualitative: Run a few user interviews or send a quick survey to understand why that page isn't working for people.

- Implement Changes: Redesign the page based on the human feedback you gathered.

- Measure with Quantitative: Use A/B testing to track if your changes actually improved the conversion rate.

This integrated strategy moves you from guessing to knowing. You're using hard data to find the smoke and human stories to find the fire. As we move through 2026, the ability to blend the clarity of numbers with the depth of narrative is what will separate good data collection from truly great decision-making.

Choosing Your Tools: From Surveys to Sensors

Once you’ve mapped out your strategy, it’s time to pick the actual instruments for the job. Think of this as filling your toolbox. A carpenter needs more than a hammer, and a researcher needs a whole range of tools, each perfect for a specific task. Getting this choice right is a huge part of building a solid data collection methodology.

Here, we'll move past the theory and get practical. Let's look at the real-world pros and cons of surveys, interviews, observational studies, and the ever-growing field of automated data from sensors and logs.

Surveys: The Scalable Pulse-Check

Surveys are popular for a reason—they are incredibly efficient for gathering information from a lot of people at once. Whether you're measuring customer happiness or testing the waters for a new product, a well-designed survey can give you a wide, quantitative snapshot, fast.

But their biggest strength, scale, can also be a weakness. Let’s be honest, traditional, static forms can feel cold and robotic. This often leads to people abandoning them halfway through or just rushing their answers without much thought. Thankfully, modern tools are changing the game.

The shift from static forms to conversational interfaces is one of the biggest leaps forward in survey design. When you turn a questionnaire into a dialogue, you meet people on their terms. The process feels less like an interrogation and more like a helpful chat.

Platforms like Formbot are a perfect example of this evolution. It uses an AI-powered, chat-like interface to ask questions one at a time, just like a real conversation. This approach can result in higher completion rates and more thoughtful data, especially on mobile, where endless scrolling forms can be a challenge. If you're weighing your options, a good survey software comparison can help you find the features that line up with your goals.

Interviews and Focus Groups: The Deep Dive

When you need to get past the "what" and really understand the "why," interviews and focus groups are your best friends. These qualitative methods open the door to deep, nuanced conversations that a survey just can't touch.

- Interviews: One-on-one chats are ideal for digging into sensitive topics or unpacking complex decisions. You have the freedom to ask follow-up questions and probe for those "aha!" moments. The trade-off? They take a lot of time and are hard to scale.

- Focus Groups: Getting a small group of people (usually 6-10) together for a moderated discussion is fantastic for revealing group dynamics and shared opinions. They're great for brainstorming or getting feedback on a new concept.

Both methods give you incredibly rich, contextual data. Just remember, the quality of your findings really hinges on the skill of your moderator and how carefully you've selected your participants.

Observational Studies: Seeing Behavior in Action

Sometimes, the best way to know what people do is to simply watch them. Observational studies involve systematically watching and recording behavior in a natural setting, without jumping in to interfere. Think of a UX researcher watching how someone actually navigates a new app, or a retail analyst tracking shopper patterns in a store.

This method is so powerful because it captures what people do, not what they say they do—and there's often a huge gap between the two. Someone might tell you in a survey that they use a feature all the time, but in practice, they behave completely differently. Observation closes that gap and gives you an unfiltered look at real-world action.

Sensors and Digital Analytics: The Passive Data Stream

Not all data collection needs an active participant. In fact, a massive amount of data is now gathered passively through digital tools and physical sensors. This covers everything from website analytics tracking every click to IoT devices monitoring warehouse temperatures.

This is a huge driver of the data analytics market, which was valued at USD 61.44 billion in 2023 and is projected to explode to USD 581.34 billion by 2033. The fastest-growing segment? Image and video data from sensors and social media, which tells you a lot about the shift toward capturing real-time behaviors. You can dig into these trends in the full data analytics market report.

This kind of data provides a continuous, real-time pulse on everything from user behavior to operational performance. It’s highly objective and can be collected on a massive scale. The real challenge, though, is turning that firehose of raw data into something meaningful—and doing it all ethically and with clear user consent.

Choosing the right tool depends entirely on what you want to learn. The following table breaks down the most common methods to help you decide which one is the best fit for your project.

Comparison of Popular Data Collection Methods

| Method | Best For | Pros | Cons |

|---|---|---|---|

| Surveys | Gathering quantitative data from a large audience quickly. | - Highly scalable - Cost-effective - Easy to analyze |

- Can have low response rates - Lacks deep context - Risk of biased answers |

| Interviews | Exploring complex topics in-depth with individuals. | - Provides rich, nuanced insights - Flexible and adaptive - Builds rapport |

- Time-consuming - Not scalable - Can be expensive |

| Focus Groups | Understanding group dynamics and shared opinions. | - Generates diverse ideas - Reveals social context - Great for brainstorming |

- Results can be influenced by dominant voices - Difficult to moderate - Small sample size |

| Observation | Capturing actual, unfiltered behavior in a natural setting. | - Highly accurate and objective - Uncovers "what people do" vs. "what they say" - Provides real-world context |

- Can be subjective without clear criteria - Doesn't explain the "why" - Potential ethical concerns |

| Sensors/Logs | Collecting continuous, objective data at a massive scale. | - Real-time and passive - Highly objective - Immense scale |

- Requires technical expertise to analyze - Lacks human context - Raises privacy and ethical questions |

Ultimately, many of the most successful research projects don’t rely on just one method. They often blend quantitative tools like surveys with qualitative approaches like interviews to get a complete, well-rounded picture.

Building Your Data Collection Methodology in 5 Steps

Alright, let's move from theory to action. A data collection methodology isn't just an abstract concept; it's your practical, step-by-step playbook for getting the answers you actually need. Following a structured process is what separates guessing from knowing—it turns a vague question into a concrete plan that delivers trustworthy insights.

Think of these five steps as building a bridge. Each one is a critical piece of the structure, making sure your research journey is stable, direct, and gets you exactly where you need to go.

Step 1: Define Your Research Objectives

Before you even think about writing a survey question or scheduling an interview, you have to know precisely what you're trying to accomplish. Vague goals will only ever lead to vague data. The first thing to ask yourself is, "What specific question am I trying to answer?" or "What problem, exactly, am I trying to solve?"

Your objectives should be SMART:

- Specific: Clearly state what you want to find out.

- Measurable: How will you quantify what you've learned?

- Achievable: Do you have the time, money, and people to do this?

- Relevant: Does this line up with your bigger business goals?

- Time-bound: Set a firm deadline for when you need the answers.

For instance, a goal like "improve our website" is useless. A SMART objective sounds more like: "Identify the top three friction points on our checkout page for mobile users in Q3 of 2026, so we can increase conversion rates by 15%." That level of clarity makes every other decision a whole lot easier.

Step 2: Choose Your Methods and Tools

Once you have a crystal-clear objective, you can pick the right tools for the job. This decision should always connect directly back to your goal. Are you trying to measure a trend across thousands of people? Or do you need to get into the heads of a few key customers to understand their motivations?

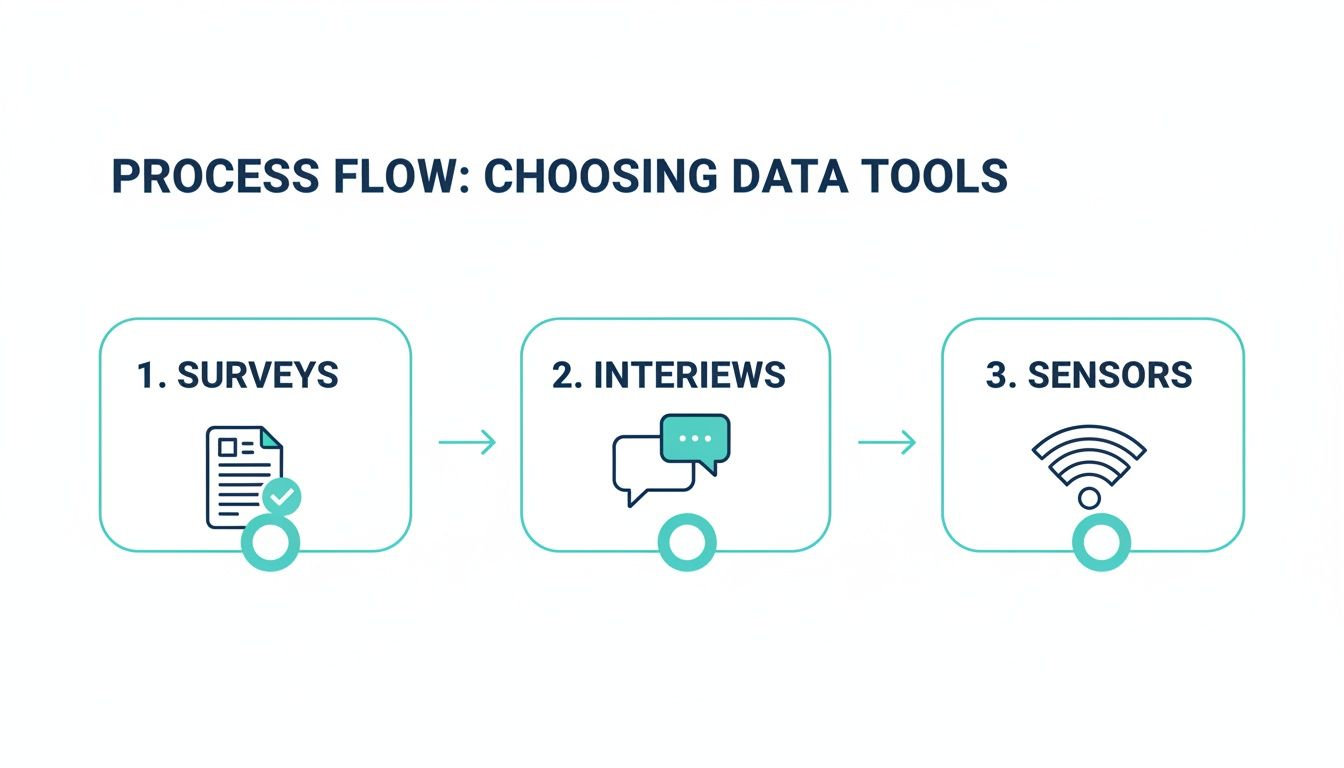

This flow chart gives a great overview of how to choose the right tool based on what you need to find out.

As you can see, surveys are your go-to for scalable, quantitative data. Interviews are perfect for digging deep into the "why" with qualitative insights. Sensors, on the other hand, are fantastic for grabbing continuous, passive data without someone having to do a thing.

The right method is simply the one that gets you closest to the truth. Often, the best approach is a mix—like using a widespread quantitative survey to spot a problem, then following up with qualitative interviews to really explore why it's happening.

Step 3: Design Your Sampling Plan

Let's be realistic: you can't talk to everyone. A sampling plan is your strategy for choosing a representative group from your larger target audience. A solid sample is what allows you to say your findings aren't just a fluke but likely apply to the whole group.

Here’s what you need to nail down:

- Target Population: Who, exactly, are you studying? Get as specific as you can. "Millennial coffee drinkers" is better than "people."

- Sample Size: How many people do you need to hear from for the results to be statistically meaningful?

- Sampling Method: Will you use random sampling, where everyone has an equal shot, or something else, like convenience sampling (which is easier but less rigorous)?

Don't rush this step. Getting your sample wrong can inject bias that completely undermines your results. A thoughtful sampling plan is non-negotiable.

Step 4: Create a Data Collection Plan

Now it's time to get down to the nuts and bolts. Your data collection plan is the logistical map for your project. Think of it as a detailed "how-to" guide that anyone on your team could pick up and follow to execute the research consistently.

This plan needs to spell out:

- Procedures: Step-by-step instructions for how you'll run surveys, conduct interviews, or set up observations.

- Timeline: A clear schedule with start and end dates for every activity.

- Resources: Who and what do you need? People, tools, budget—list it all.

- Data Management: How will you record the data? Where will you store it? How will you keep it safe?

A detailed plan is your best defense against errors. It ensures everyone collects data the same way, which is absolutely vital for reliable results.

Step 5: Plan for Data Quality and Ethics

Finally, don't treat quality control and ethics as an afterthought. Build them into your methodology right from the start. High-quality data is accurate, consistent, and unbiased. Low-quality data is worse than no data at all—it’s actively misleading.

In fact, poor data from flawed collection methods can completely kill the effectiveness of AI and machine learning models. The world is projected to create a staggering 181 zettabytes of data by 2026, so scalable and accurate methods are essential. You can dig deeper into these trends in this comprehensive data collection and labeling industry report.

Ethical considerations are just as critical. This means getting informed consent from participants, protecting their anonymity, and being totally transparent about how you’ll use their data. Building trust isn't just a nice thing to do—it’s the only way to get people to share honest, meaningful information with you.

Upholding Data Quality and Ethical Standards

Collecting data isn't just a mechanical process; it comes with a serious responsibility. Your entire project hinges on two things: the trustworthiness of your information and the respect you show the people providing it. If either of these is shaky, even the most brilliant methodology will crumble.

This means you need to be just as focused on the integrity of your data as you are on the human element behind it. Let's dig into what it takes to get these non-negotiables right.

The Cornerstones of Data Quality

High-quality data is the bedrock of good decisions. To achieve it, you have to focus on a few core ideas that ensure your findings are both accurate and consistent. Think of these as the essential quality control checks for your research.

The two most important measures here are validity and reliability.

- Validity asks: "Am I actually measuring what I think I'm measuring?" It’s all about accuracy. For example, if you want to gauge customer satisfaction but your survey only asks about website loading times, your data isn't valid for that specific goal.

- Reliability asks: "If I ran this same test again, would I get similar results?" This is purely about consistency. A reliable method gives you stable, predictable outcomes every single time.

A method can be reliable but not valid—like a bathroom scale that consistently tells you you're five pounds heavier than you really are. The goal is to be both: consistently hitting the correct target.

Getting there means taking proactive steps to prevent errors and weed out bias. This could involve pilot testing your surveys to find confusing questions, training interviewers to remain neutral, and using crystal-clear language in all your materials. When you're using modern tools, it's also critical to know their limitations. For instance, if you're transcribing interviews, it's worth understanding AI transcription accuracy to make sure the audio is converted to text precisely.

Putting Ethics at the Forefront

Beyond the numbers and text, your methodology has to put the people providing the data first. Ethical data collection is about building trust and protecting participants from any potential harm. This isn't just a box to tick—it's the foundation for getting honest, high-quality responses.

Key ethical principles you can't ignore include:

- Informed Consent: This is way more than just getting a signature. It means clearly explaining the purpose of your study, how the data will be used, and any potential risks, so people can make a genuinely informed decision to participate.

- Confidentiality and Anonymity: You have a duty to protect your participants' identities. This often means anonymizing data by stripping out personal identifiers like names and email addresses. When dealing with sensitive information, especially in healthcare, using tools that meet strict standards is crucial. Learning about https://tryformbot.com/blog/hipaa-compliant-online-forms can give you a solid framework for handling private health information the right way.

- Secure Data Handling: Where will you store the data, and who gets to see it? From the moment you collect it, you need a secure plan for storing and eventually destroying the information to prevent any breaches.

By weaving these principles into your plan from the very beginning, you ensure your research isn't just effective, but also responsible. Upholding these ethical and quality standards is what gives your data collection methodology—and the insights you draw from it—true integrity.

How Modern Tools Are Changing the Game

Think of your methodology as the blueprint for your project. The tools you use? They're the power drills and laser levels that actually build the thing. Technology is completely overhauling the old, clunky ways of collecting data, turning what used to be a chore into a real strategic advantage. We can finally move past the era of impersonal, boring forms that everyone hates filling out.

The biggest shift is happening in how we ask for information. New platforms are redefining the very idea of a what is a data collection methodology by making the process conversational. Instead of handing someone a static checklist, these tools create a dynamic dialogue, making the whole experience feel more natural and engaging. This one change makes people far more likely to not only finish a survey but also give you more thoughtful, detailed answers.

Smarter Collection, Better Results

So, what does this actually mean for your data? It means a huge jump in both quality and quantity. AI-driven tools can now understand what people are typing, ask smart follow-up questions on the fly, and even validate information in real-time to catch mistakes before they mess up your dataset. The impact on the bottom line is real.

- Higher Completion Rates: Simply making a form conversational can help boost completion rates.

- Improved User Experience: The one-question-at-a-time flow works beautifully on mobile devices, helping people complete forms more easily.

- Improved Accuracy: When you reduce user frustration with a friendly interface and smart validation, you can get fewer careless errors.

This is all about meeting people where they are. When giving feedback feels less like taking a test and more like texting a helpful assistant, the whole dynamic changes. You get better data because you're providing a better experience.

Practical Applications Across Teams

This isn't just theory; it’s already happening in businesses everywhere. Teams are using these modern tools to fundamentally change how they work. For example, when you're dealing with hours of interview recordings, using a tool like AI-powered transcription software can be a lifesaver, accurately capturing qualitative data so you can focus on the analysis.

Marketing teams are using conversational forms to qualify leads, guiding prospects through a journey that feels personal, not scripted. HR departments create a more welcoming first impression for job candidates, and product teams can finally get the nuanced user feedback that a simple star rating could never provide.

Tools like Formbot make this accessible for everyone. With a free plan to get started, any team can start building and testing these experiences right away—no coding required. It puts powerful data collection right at your fingertips.

Frequently Asked Questions

Getting a handle on data collection methodology can feel like a big task, but a few key concepts can clear things up. Here are some straightforward answers to the questions we hear most often.

What Is the Difference Between Data Collection and Data Analysis?

Think of it like building with LEGOs. Data collection is the part where you gather all the bricks you need—the survey responses, interview notes, or website click data. It's the raw material.

Data analysis is when you start snapping those bricks together. You sort them by color and size, look for patterns, and build something meaningful. Collection gets you the pieces; analysis tells you what you can build with them.

How Do I Know if My Sample Size Is Big enough?

This is a classic question, and the answer isn't just "more is better." A sample that's too small won't give you a reliable picture of your whole audience. But one that's too big is just a waste of resources.

The goal is to find the sweet spot. You need to think about your acceptable margin of error and how certain you need to be (most researchers aim for a 95% confidence level). For many business projects, a carefully selected sample of a few hundred people is plenty to spot important trends.

Is It Okay to Use More Than One Collection Method?

Not only is it okay, it's often a fantastic idea. This strategy is called mixed-methods research, and it gives you a much richer, more complete picture than a single method ever could.

For instance, you might start with a broad quantitative survey to get the "what"—the hard numbers from a large group. Then, you could follow up with a few in-depth qualitative interviews to uncover the "why" behind those numbers. It’s like getting both the 10,000-foot view and the story on the ground.

How Is AI Impacting Data Collection Today?

In 2026, AI is no longer a futuristic concept; it's a practical tool that’s changing the game. AI automates the tedious stuff, like sifting through open-ended comments for themes, and it can personalize the data collection experience on the fly.

Imagine a form that adapts its questions based on your answers or clarifies what it's asking if you seem confused. That’s what AI does—it makes the process conversational and smarter, which leads to better, more accurate data.

Ready to see what a smarter, conversational approach can do for your data collection? Formbot helps you build AI-powered forms that are actually enjoyable to fill out. Give it a try for free and watch your completion rates climb.